Healthcare Advisory

“We provide Executive Level Leadership

for the Investment Department "

Michael Anderson

President and Chief Investment Officer

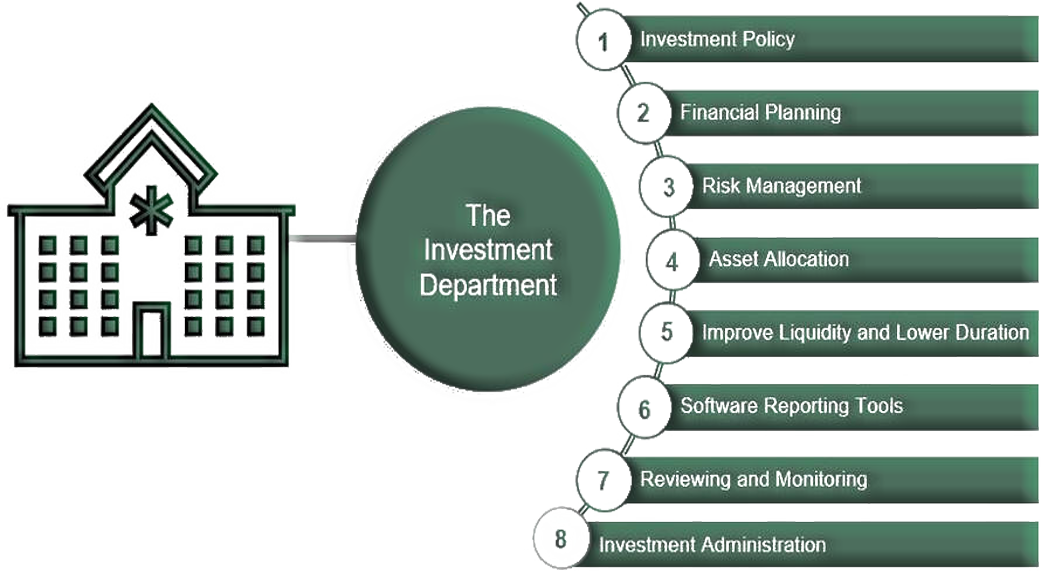

In healthcare, an Investment Department serves as the foundation for maximizing financial asset performance and generating additional income. Hi-Line Capital Management provides leadership in this area, guiding organizations in leveraging their assets effectively. We specialize in coordinating people, processes, and policies to drive successful investment outcomes. Additionally, we focus on building both internal and external teams dedicated to continuous improvement, ensuring a disciplined and strategic approach to long-term financial growt

Why Create an Investment Department?

Hi-Line Capital Management applies best practices for healthcare investing, ensuring a strategic and disciplined approach to financial management. We emphasize intelligent investing, aligning investment strategies with an organization’s mission to create meaningful, long-term impact. Our approach is guided by a unified set of beliefs that define fundamental investment principles and long-term truths. Success in healthcare investing requires the right team, with the right people in the right roles, driving informed decision-making. Additionally, we provide expertise in risk management and a deep understanding of market dynamics, helping organizations navigate financial complexities with confidence.